The President is announcing an historic agreement between the Department of Justice and the Federal Maritime Commission (FMC) to make sure that large ocean freight companies cannot take advantage of U.S. businesses and consumers. Right now, three global alliances, made up entirely of foreign companies, control almost all of ocean freight shipping, giving them power to raise prices for American businesses and consumers, while threatening our national security and economic competitiveness.

Most traded goods—everything from the housewares you buy online to the agricultural products American farmers market overseas—are transported by ocean freight companies. These companies have formed global alliances—groups of ocean carrier companies that work together—that now control 80% of global container ship capacity and control 95% of the critical East-West trade lines. This consolidation happened rapidly over the last decade. From 1996 to 2011, the leading three alliances operated only about 30% of global container shipping. Significant consolidation occurred in the years running up to the Pandemic.

Since the beginning of the pandemic, these ocean carrier companies have been dramatically increasing shipping costs through rate increases and fees. They increased spot rates for freight shipping between Asia and the United States by 100% since January 2020, and increased rates for freight shipping between the United States and Asia by over 1,000% over the same period. Oftentimes cargo owners are charged fees—known as “detention and demurrage” fees—even when they can’t get access to their containers to move them. The FMC estimates that from July to September of 2021, eight of the largest carriers charged customers fees totaling $2.2 billion—a 50% increase on the previous three-month period.

These historically large shipping price increases translate into higher prices for American consumers. Based on research by the Kansas City Fed and the European Central Bank, these shipping cost increases are expected to contribute to approximately a 1% increase in consumer prices over the next year.

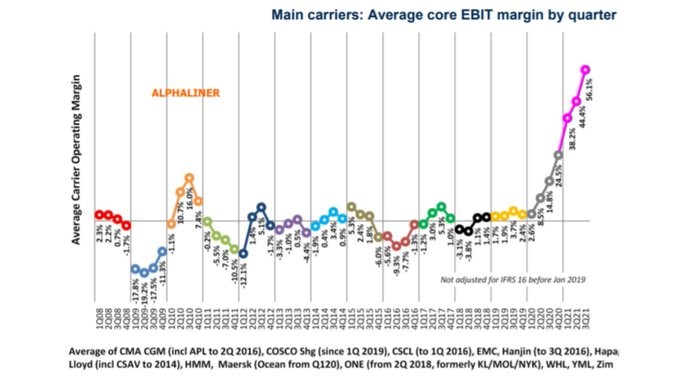

Meanwhile, the ocean carrier companies are experiencing elevated profits and soaring profit margins. Estimates suggest that the container shipping industry made a record $190 billion in profits in 2021, a seven-fold increase from the previous year and five times what it made over the entire period from 2010-2020. Profit margins have increased by even larger amounts. In the third quarter of 2021, the average operating margin of the major carriers was about 56%, compared to an average operating margin of 3.7% two years earlier:

Beyond price increases, several specific business practices of many large ocean carrier companies are hurting American businesses and farmers. For example, because of their market power, these alliances are able to cancel or change bookings and impose additional fees without notice. These unpredictable practices undermine American business’ ability to deliver orders on time. All too often, ocean carriers are effectively refusing to take American exports altogether, preferring to speed back to China with an empty ship to make a quick turnaround rather than transport American exporters’ cargo or dock at American ports. This is especially difficult to our farmers, who have spent decades building relationships internationally, only to find that now they can’t transport their agricultural products overseas with any reliability or predictability.

The carriers have also continued to pursue practices that directly contribute to port congestion, such as imposing “box rules” that require truckers to use only certain trailers to haul their containers—thus forcing truckers to wait for the “right” kind of trailer to become available. That leads to lower pay and longer wait times for our nation’s truck drivers, who get paid per box, and allows the ocean carriers to generate even higher detention and demurrage fees.

A century ago, in the original Ocean Shipping Act, Congress provided for utility-style regulation of ocean carriers, paired with antitrust immunity for ocean carrier alliance agreements only when the alliance was in the “public interest.” But Congress steadily deregulated the industry—expanding the antitrust immunity while weakening ocean carriers’ obligations to publicly disclose prices and fees and treat businesses and their customers fairly. That is how we have arrived at the point where three alliances can dominate the market for ocean shipping and squeeze American businesses and consumers.

The Biden-Harris Administration is taking steps to lower consumer prices and level the playing field in ocean shipping:

- Today, the FMC and the Department of Justice (DOJ) are announcing a new joint initiative to promote competition in the ocean freight transportation system. Under the new initiative, DOJ will provide the FMC with the support of attorneys and economists from the Antitrust Division for enforcement of violations of the Shipping Act and related laws. The FMC will provide the Antitrust Division with support and maritime industry expertise for Sherman Act and Clayton Act enforcement actions. The agencies’ announcement explains that competition in the maritime industry is integral to lowering prices, improving quality of service, and strengthening the resilience of supply chains.

This initiative grew out of the “whole of government” approach to competition established by the President’s July Executive Order on Promoting Competition. The FMC and the DOJ are both part of the White House Competition Council established by the Order. Their partnership builds on an information-sharing Memorandum of Understanding that the agencies entered into in July.

- The FMC will continue ramping up oversight of the global ocean shipping industry. Since last summer, the FMC has established a new audit program backed by an audit team to address complaints about carriers charging unfair fees, demanded justification from the carriers about their fees, launched 42 cases investigating port congestion charges, and took steps to address barriers to filing complaints at the FMC and to prevent retaliation against complainants. It also launched a new data initiative to identify data constraints that are adding to supply chain congestion. This month, the FMC also sought comments on reforms to how carriers charge shippers fees.

The Administration, led by Port Envoy John Porcari, has also worked with the Ports of Los Angeles and Long Beach to develop new fees on ocean carrier companies for letting cargo sit on the docks for over nine days. These long-dwelling import containers had been causing delays in getting goods to shelves while increasing port congestion. Since the announcement of the proposed fee, the number of long-dwelling containers on the docks has fallen more than 70 percent. Building on the success of the proposed carrier fee, the Administration is working with the ports on charging the carriers for long-dwelling empty containers that have been clogging the docks. There has been a more than 25 percent drop in the number of empty containers on the docks at the Port of Los Angeles since that announcement.

The need for reform to our ocean freight transportation system to improve fluidity and fairness, particularly for our agricultural exporters, was underscored last week in reports released by the Department of Transportation and the Department of Agriculture (USDA) as part of the Administration’s six supply chain industrial base reports published on the one-year anniversary of the President’s supply chain executive order.

- The President is calling on Congress to pass robust reforms to the ocean shipping industry, including reforms that address the current antitrust immunity for ocean shipping alliances. In addition to the important administrative actions announced today, the President believes Congress should provide additional tools for the Administration to address problems in the ocean shipping industry. The President is encouraged by action in both Houses of Congress to address these problems. He is calling on Congress to also address the immunity of alliance agreements from antitrust scrutiny under current law.

###